Pink Diamond Statistics

WANT TO KNOW HOW MUCH

YOUR PINK DIAMOND IS WORTH?

Pink diamond price calculator

STATISTICAL DIFFERENCES BETWEEN ARGYLE ORIGIN (AO) AND ARGYLE CERTIFIED PINK DIAMONDS.

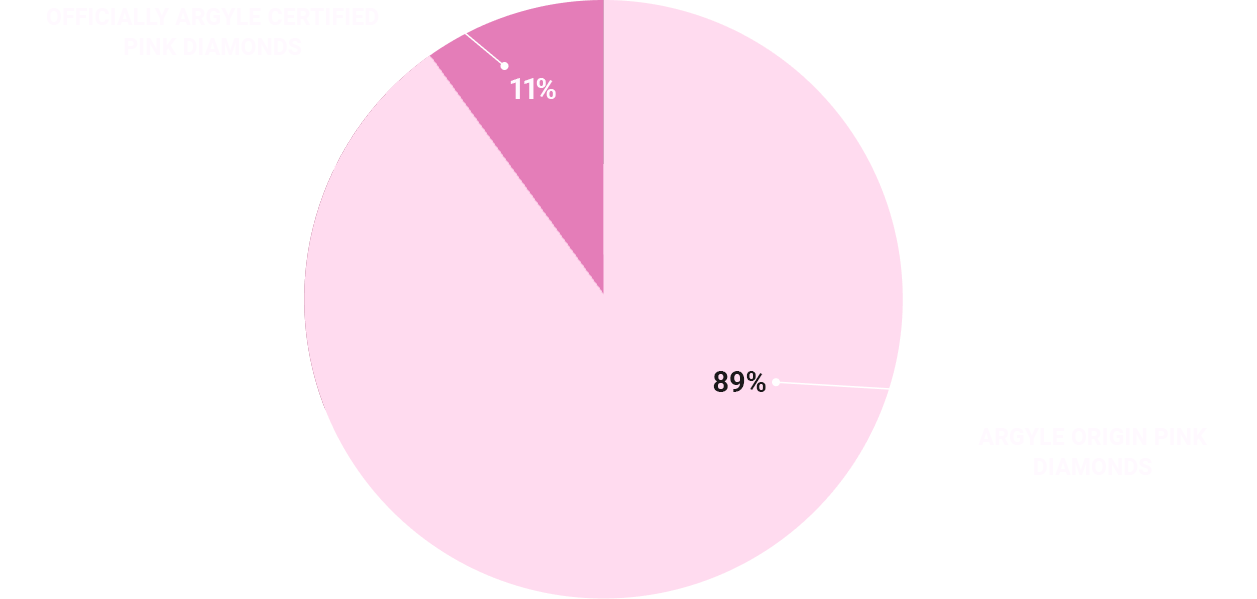

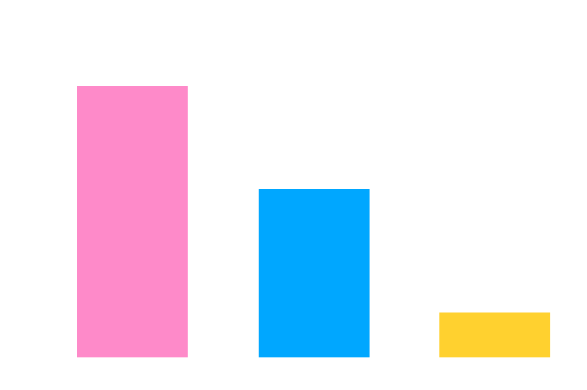

Total pink diamond distribution from

1984 to 2023

The Rio Tinto-owned Argyle diamond mine accounts for 90% of the global pink diamond rough production. In the 37 years of its operation, the mine generated an estimated 86,500 carats of pink diamond rough. From that vast amount Rio Tinto only retained an estimated 11% percent, or 9,194 carats of polished Pink (P), Pink Rose (PR) and Purplish Pink (PP) diamonds for their prestigious Argyle brand. Only an official Argyle certified pink diamond is considered a BLUE-CHIP investment option, as most Argyle Origin (AO) pink diamonds were never cut, polished, inscribed, or graded by the Argyle mine and have little to no historical significance. This is because of their widespread availability, and lack of the chain of custody as set by the Argyle mine.

Pink Diamond Price Growth 2025

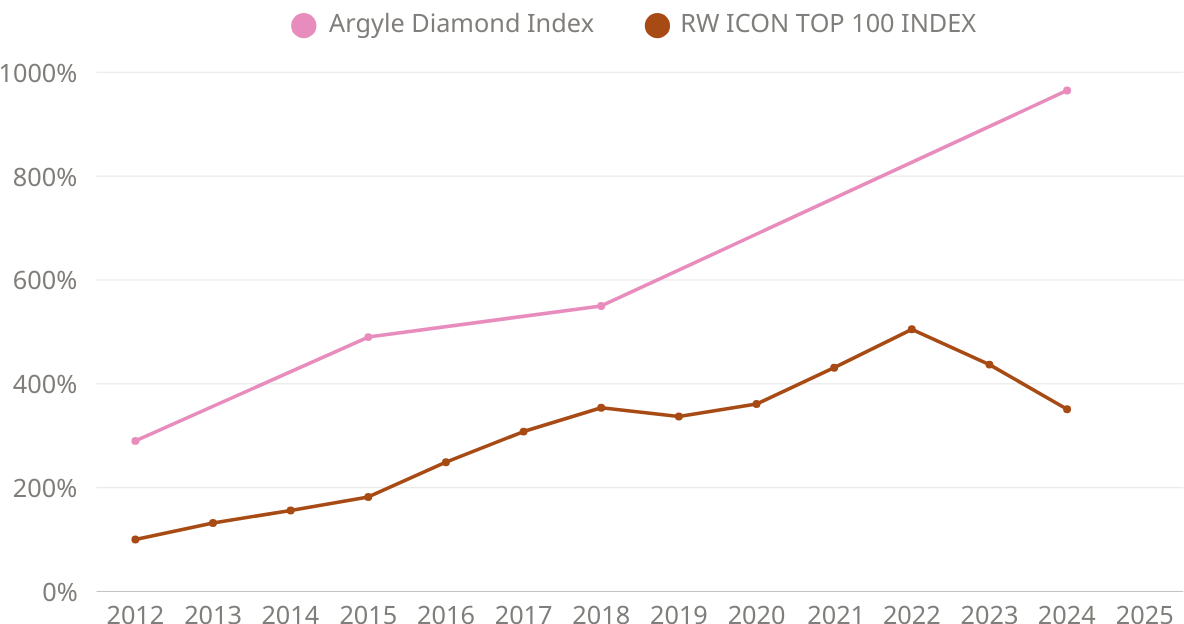

Argyle Diamond Index Vs TOP 100 rare whiskey INDEX 2012-2024

At the beginning of 2022, there was a significant surge in the cost of casks whiskey. This was attributed to a decrease in the availability of barrels and an increase in the number of companies selling casks whiskey as an investment, unfortunately, many of these companies charged premiums above market value, coursing overall cask prices to reach a point where they were no longer viable, causing many independent bottlers to decrease or cease their orders. Multiple indexes suggest that the decrease in cask auction prices is ongoing, indicating the secondary whiskey market is in a state of downturn. This decline points towards a potential plateau in future price increases within the cask industry. (Forbes, Carsk Trade, The Spirits Business)

Argyle Diamond Index Vs TOP 100 ART INDEX 2020-2024

Art investments are typically not correlated with traditional financial markets like stocks and bonds. Meaning that art’s performance may not align with broader economic trends or provide consistent returns. Historically the price performance of certified pink diamonds from the Argyle mine had a strong correlation with fine art. However, since 2012, Argyle certified diamond prices have risen substantially, well surpassing the floundering performance of the Top 100 Art Market Index.

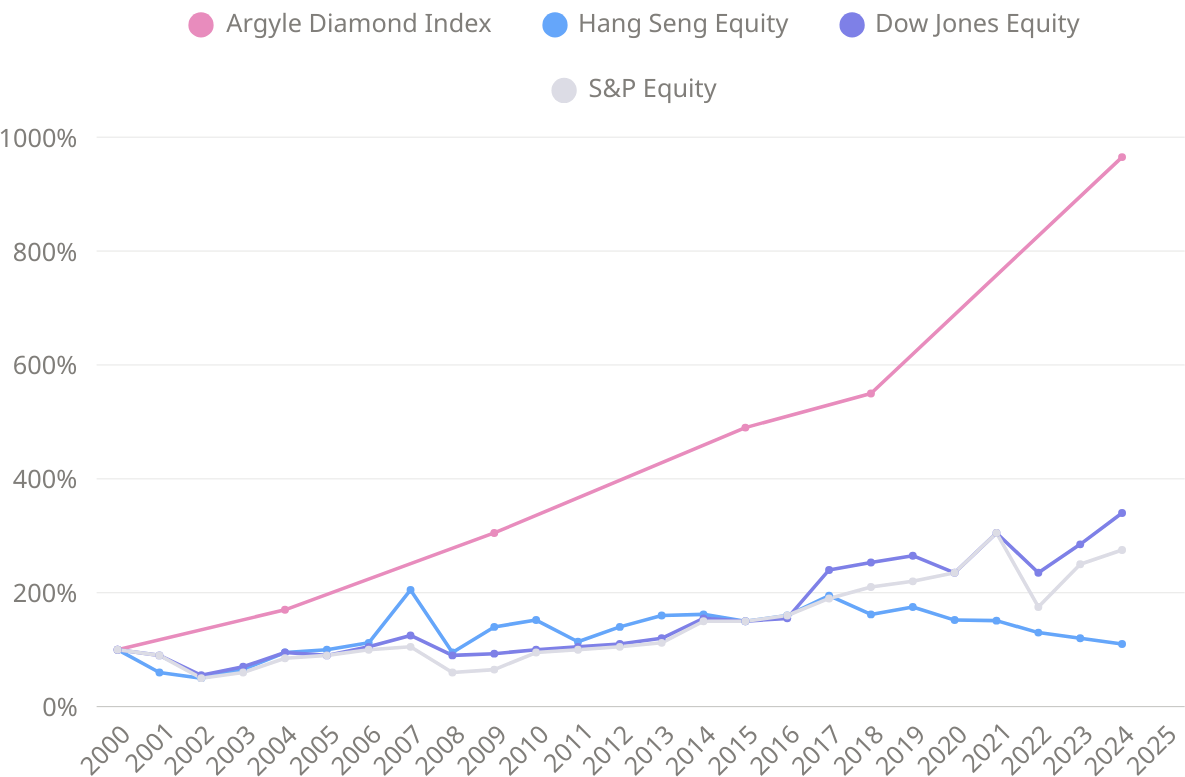

Argyle Diamond Index Vs Hang Seng – Dow Jones – S&P 2000-2024

Certified pink diamonds from the Argyle mine have demonstrated remarkable price growth since 2000, consistently outperforming major stock shares during the same period. By 2024, Argyle quality-adjusted prices reached their highest point ever, surpassing the previous peak observed in 2021. This trend highlights their enduring appeal, reflecting strong demand and appreciation in the alternative investment market.

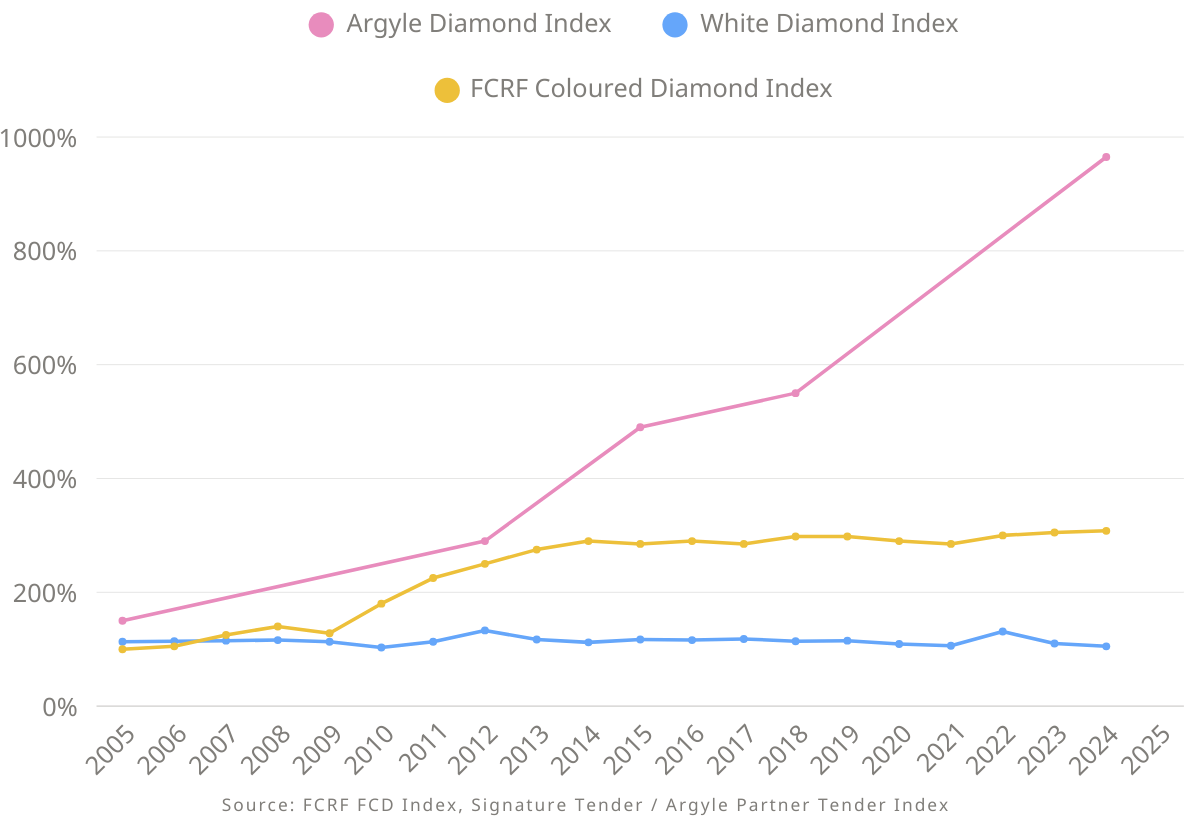

Argyle Diamond Index Vs White Diamond Index vs all fancy coloured diamond index 2005-2024

Certified pink diamonds from the Argyle mine have consistently exhibited a robust history of price appreciation over the past two decades. According to data provided by Rio-Tinto and the Fancy Colour Research Foundation from 2005 to January 2024, the overall value of pink diamonds increased by an average of 398%. With Argyle specific diamonds far exceeding these statistics by more than 300% within the same time duration. These expansions reinforce that certified diamonds from the Argyle mine have a historically higher growth rate than most other alternative asset classes.

Fancy Colour Diamond Price Index

Fancy Colour Research Foundation

2005-2025 Average Annual Growth

ALL SIZES, ORIGINS, AND INTENSITIES, IN PINK, BLUE AND YELLOW

New York, April 23, 2025: Q1 2025 FCRF Fancy Colour Diamond Index Results

Since the inception of the Fancy Colour Research Foundation in 2005, there has been a notable appreciation in the value of all Fancy Colour Diamonds, resulting in an overall increase of 205%. Pink diamonds across all origins, shapes, sizes, and colour intensities have witnessed the most significant gains of 393.5%, with Argyle certified pinks far exceeding this percentage, while yellow diamonds have seen a notable 49.3% increase and blue diamonds a respective 242.4% upsurge.

The Fancy Colour Research Foundation (FCRF) offers evidence-based assistance in comprehending Fancy Colour Diamonds as a viable asset class. The Fancy Colour Research Foundation (FCRF) is a non-trading organisation dedicated to promoting transparency and fair trade within the diamond industry. This is achieved through the utilisation of the Fancy Colour Diamond Price Index, which incorporates comprehensive data on rarity, auction analyses, commercial research, and objective valuations.

WANT TO KNOW HOW MUCH

YOUR PINK DIAMOND IS WORTH?

PINK DIAMOND PRICE CALCULATOR

DIAMOND BROKERAGE SERVICE

The diamond brokerage service is a personalised support facility that is dedicated to meeting the unique needs and preferences of our valued clients. These services include providing statistical diamond analytics and curated selling strategies tailored to your individual preferences and financial goals.

Contact us today

Craig Leonard

CEO & managing director of APDTC

The Australia Pink Diamond Trade Centre is a family-owned and operated business, managed by the Leonard family, who have maintained their presence at the same location for over 90 years.

The CEO, Craig Leonard, is a registered valuer with the National Jewellery Valuers Association (NJVA) and holds accreditations from both the Gemological Institute of America (GIA) and the Gemmological Association of Australia (GAA). With more than 30 years of experience in the diamond industry, he is recognised as one of the world’s foremost authorities on pink diamonds sourced from the Argyle mine.